Page 5 - WFTR 2019 eBook

P. 5

World FinTech Report Interactive eBook

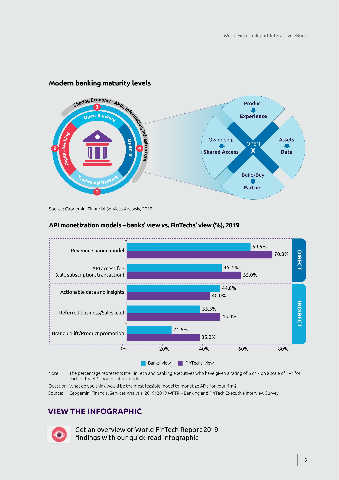

From Open Banking to Open X Modern banking maturity levels

Product

Even though Open Banking has yet to reach maturity, the financial services industry is entering 3

a new phase of innovation – one we call “Open X” – where all players will leverage data and Experience

create a shared marketplace.

Marked by data-sharing and collaboration between FS and non-FS firms, the Open X era will Sharing Economy - APIS, Information, Infrastructure Ownership Assets

see banks embed themselves seamlessly into the customer journey and holistically address 2 4 OPEN

X

their customers’ needs. Shared Access Data

The advent of Open X is being driven by four fundamental shifts:

Traditional Banking Build/Buy

Prioritizing customer experience over products

Partner

Strategically leveraging data, thereby making it a critical asset 1

Partnering with ecosystem players, instead of internally developing products or

buying capabilities Source: Capgemini Financial Services Analysis, 2019

Sharing access, as opposed to solely owning assets and capabilities

API monetization models – banks' view vs. FinTechs' view (%), 2019

Applied Programming Interfaces (APIs) will be key to success in Open X, which will require

ecosystem players to broadly adopt open APIs for enabling the four fundamental shifts. Banks 59.5%

are already leveraging open APIs, with nearly 89% of banks using them for collaborating with Revenue-sharing model 70.0%

FinTech firms. Moreover, external API sharing is rapidly picking up, with 66% of banks DIRECT

indicating that they share APIs with trusted partners (and approximately 27% planning to API access fee 45.7%

share APIs within a year). In this environment, API standardization is crucial to help reduce (call, subscription, transaction) 55.0%

fraud, improve interoperability between systems and increase scalability. 44.8%

Actionable data and insights

Additionally, banks will see success in Open X by switching from direct API monetization 40.0%

models where incremental income is tied to specific transaction to indirect API 35.3%

monetization models. This will offer additional ways to create revenue, including referred Referred business/Sales lead 45.0% INDIRECT

business, brand uplift, and actionable data models that help expand distribution channels,

amplify a company’s brand and improve cross-selling opportunities to improve the customer Brand uplift/Product promotion 21.6% 35.0%

experience.

0% 20% 40% 60% 80%

WATCH THE VIDEO Banks’ view FinTechs’ view

Note: The percentage represents the FinTech and banking executives who have given a rating of 6 or 7 on a scale of 1–7 for

The financial services industry is each of the API monetization models.

shifting from open banking to an Question: What do you think would be the most feasible model to monetize APIs for your firm?

impending phase we call Open X. Source: Capgemini Financial Services Analysis, 2019; 2019 WFTR – Banking and FinTech Executive Interview Survey.

View the World FinTech Report

2019 video to learn how banks VIEW THE INFOGRAPHIC

and FinTechs can thrive in

this Open X shared marketplace.

Get an overview of World FinTech Report 2019

findings with our quick-read infographic

4 5