Page 6 - WFTR 2019 eBook

P. 6

World FinTech Report Interactive eBook

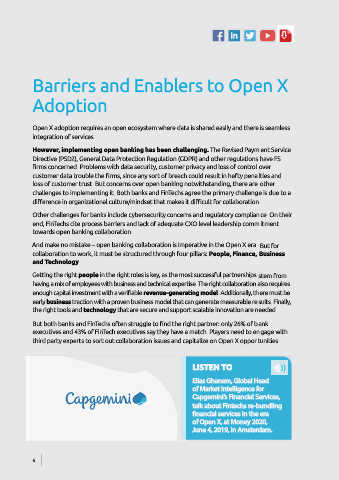

Barriers and Enablers to Open X Top 3 open banking concerns – banks’ view vs. FinTechs’ view (%), 2019

Adoption 75.9% 50.0% 75.9% 50.0% 62.9%

37.5% Banks’ view

FinTechs’ view

Open X adoption requires an open ecosystem where data is shared easily and there is seamless

integration of services. Note: The percentage represents the FinTech and banking

executives who have given a rating of 6 or 7 on

However, implementing open banking has been challenging. The Revised Payment Service a scale of 1–7 for each of the open banking concerns.

Question: What level of concern do your firm have in the

Directive (PSD2), General Data Protection Regulation (GDPR) and other regulations have FS Data security Customer Loss of following areas when adopting open banking?

control of

firms concerned. Problems with data security, customer privacy and loss of control over privacy customer data Source: Capgemini Financial Services Analysis, 2019; 2019

customer data trouble the firms, since any sort of breach could result in hefty penalties and WFTR – Banking and FinTech Executive Interview Survey.

loss of customer trust. But concerns over open banking notwithstanding, there are other

challenges to implementing it. Both banks and FinTechs agree the primary challenge is due to a Challenges for implementing open banking – banks' view vs. FinTechs' view (%), 2019

difference in organizational culture/mindset that makes it difficult for collaboration.

65.5% 70.0% 64.7% 62.1% 60.0% 70.0% 60.0%

Other challenges for banks include cybersecurity concerns and regulatory compliance. On their 54.3% 54.3% 52.5% 51.7%

42.5%

end, FinTechs cite process barriers and lack of adequate CXO level leadership commitment 35.0% 36.2%

towards open banking collaboration.

And make no mistake – open banking collaboration is imperative in the Open X era. But for

collaboration to work, it must be structured through four pillars: People, Finance, Business IT incompatibility Lack of

Lack of

and Technology. Difference in Cybersecurity Regulatory long-term between banks' Process adequate

organizational concerns compliance vision and legacy systems barriers CXO level

leadership

Getting the right people in the right roles is key, as the most successful partnerships stem from culture/mindset objectives and FinTechs’ commitment

IT systems

having a mix of employees with business and technical expertise. The right collaboration also requires

enough capital investment with a verifiable revenue-generating model. Additionally, there must be Banks’ view FinTechs’ view

early business traction with a proven business model that can generate measurable results. Finally, Note: The percentage represents the FinTech and banking executives who have given a rating of 6 or 7 on a scale of 1–7 for

each of the challenges.

the right tools and technology that are secure and support scalable innovation are needed. Question: In your opinion, what are the major roadblocks and challenges that can hinder an effective collaboration

through open banking between banks and FinTechs?

But both banks and FinTechs often struggle to find the right partner: only 26% of bank Source: Capgemini Financial Services Analysis, 2019; 2019 WFTR – Banking and FinTech Executive Interview Survey.

executives and 43% of FinTech executives say they have a match. Players need to engage with

third party experts to sort out collaboration issues and capitalize on Open X opportunities.

Being able to onboard fintechs partners quickly is an essential competitive advantage.

The more efficiently a big company can do this, the faster they can bring pioneering

LISTEN TO products to market.” — Niall Cameron

Global Head of Corporate and Institutional Digital, HSBC

Elias Ghanem, Global Head

of Market Intelligence for

Capgemini’s Financial Services, Participation from FinTechs and rising customer expectations are some of the

talk about Fintechs re-bundling best things that have happened in the financial industry. They force incumbents

nancial services in the era to leave their comfort zone, change their business model, culture, and technology

of Open X, at Money 2020, architecture to trigger a digital transformation tsunami.”

June 4, 2019, in Amsterdam. — Siew Choo Soh

Head of Consumer Banking and Big Data/AI Technology, DBS

6 7